With the present U.S. economy, there has never been a better time to buy real estate, so join the rising ranks of home owners. You can find a lot of low rates in today’s market, and this means that most properties are low-risk in terms of investment. Taking this advice will get you on the path to nearly guaranteed profits.

Be moderate in your approach when considering a purchase of real estate property. Many times people are too aggressive because they are trying to get the best price, and they end up losing out entirely. Simply state your preferences and then let the lawyer and the Realtor handle the negotiations as their job descriptions require!

When negotiating with a seller, make a reasonable offer. Many individuals want to try an extremely aggressive approach, but this doesn’t always work in their favor. Simply state your preferences and then let the lawyer and the Realtor handle the negotiations as their job descriptions require!

When thinking about moving, take some time to explore the area around your potential purchase on the world wide web. You will be able to find a lot of information, even about small towns. Research how populated the area is and what its unemployment and salary rates are before making any purchases. This will ensure you’ll be making the money you need to when living in the area.

Make sure to contact people you helped to buy a house every holiday, and on anniversaries of their first day in the house. This will remind people of how helpful you have been to them during their real estate experience. At the close of your greeting, remind them that you work on a referral basis and would consider it a compliment if they would recommend you to their friends.

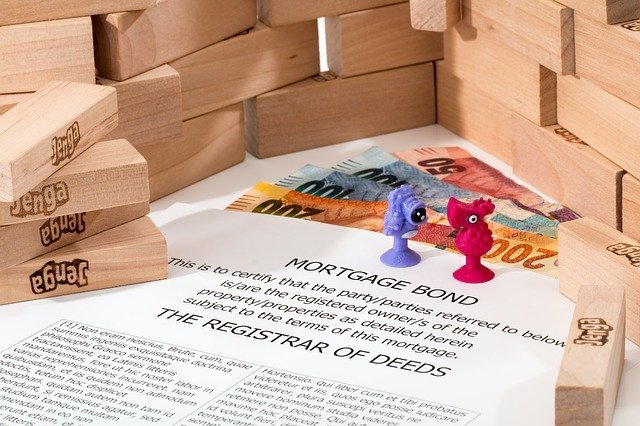

When deciding to purchase a large and commercial piece of real estate, make sure you get a trustworthy partner. It can make it way easier to get the loan you need. Having a partner gives you an extra person to help pay the necessary down payment and any needed credit in order to be qualified for a loan.

If you’ve provided an offer to a seller who didn’t accept it, do not completely give up on the fact that they won’t find a method of making the purchase price affordable for you. The seller might be able to reduce the price, repair things or share the closing cost.

If you made an offer to purchase a home but the seller rejected it, do not be discouraged. The seller may still find some way to complete the deal. The seller may offer to make some repairs that you want done or pay for closing costs.

Try to think about the long term when you are buying a new home. You may not have any kids at this point in your life but if you plan to live in the home that you are buying now, you may want to look into the schools in the area to be sure that they will do well for any future children you may have.

Think about the future when shopping for a home. You may not have any kids at this point in your life but if you plan to live in the home that you are buying now, you may want to look into the schools in the area to be sure that they will do well for any future children you may have.

Get a checklist from your Realtor. There are many Realtors that have a checklist like this already prepared. It covers the entire home-buying process, from choosing a house to getting a loan. Checklists are very helpful and ensure that you breeze right through the process from start to finish.

Make sure you have an emergency fund set aside for extra costs that arise while purchasing property. Real estate buyers generally take into account only the amount of the down payment, relevant taxes that will be charged, and funds needed by the bank when determining closing costs. Very often, closing costs also include some items that pertain to the area in which you are buying, such as improvement bonds, school taxes, and so on.

Set aside a fund for unexpected expenses linked to the new property. The closing costs can usually be calculated by adding the real estate taxes, points and down payment together. However, there may be additional items such as appraisals, surveys or home association fees.

Educate yourself on mortgage loan terms before you look into purchasing real estate. Confusion can be kept to a minimum by knowing how mortgage terms impact your monthly payments, as well as the entire cost over the duration of the loan.

Prior to purchasing any real estate, you first need to have a firm understanding of what a mortgage loan is and its many terms and conditions. When you understand how your mortgage term affects your monthly payments, and how it will impact the total cost of your loan, you will minimize any future confusion.

Before you buy a house, hire a home inspector. You don’t want to have a home that needs tons of renovating. Not only will you have to pay a lot to fix everything, you may even have to live somewhere else while your new home is getting fixed.

Buy a house with more than one fireplace only if your climate necessitates it. Learn more about fireplaces and find out how much getting one cleaned regularly costs before making your decision.

Buying a home with more than one fireplace is expensive and unnecessary. It can be difficult to keep up with fireplaces, especially if you don’t use them.

If you plan on buying a foreclosed house, also plan on doing some repairs. This is because these houses generally sit unattended for a while before they are put up for sale, and this means that there has been no regular looking after and care. Many foreclosed homes may have pests, and might need a new HVAC system.

If you are buying a foreclosed home, you should assume that it will need repairs. If you decide to buy one of these bargains, be sure to get a thorough inspection done before purchasing it. It is common for foreclosed homes to have pests, or require a new HVAC system.

Those who are wise and jump into this swirling market should follow the above article closely. It will help you avoid trouble and walk away with real estate that is under-priced and growing constantly in value. The key is to purchase the property and hold until the time is right before you make your big move.

Always do research before buying a property. Do not jump on a deal because you believe the price is interesting. You will only end up losing money. Make sure you know about the market, local incomes, home values and information on the local schools before you make a purchase on a property.